Two Georgia Universities Launch Joint Initiative To Support Tech Industry

December 4, 2019

5 Strategies For Startups To Protect Intellectual Property Rights

December 19, 2019Silicon Valley’s Unicorns are in trouble. And with recent news about WeWork and other billion-dollar startups floundering after significant investment from VCs, many (myself included) have been asking if just a small percentage of the billions were invested in women and people of color, where would we be today? After all, diverse teams show significant returns to investors and have a higher track record of success than all-white male teams. But, hey, what do I know?

While there have been notable efforts to bridge the chasm of funding Black and Latinx founders receive, the overwhelming majority of VC’s continue to invest in younger versions of themselves. In fact, most venture-backed startups are “overwhelmingly white, male, Ivy League-educated, and based in Silicon Valley,” according to a recent study conducted jointly by DiversityVC and RateMyInvestor.

Still, Black and Latinx women are the fastest-growing sector of entrepreneurs, and they are starting businesses that ultimately contribute jobs and dollars to the overall economy. Despite this impressive feat, they are still not viewed as viable investments. So how to solve the problem? One way, I think, would be to increase the number of Black and Latinx women VCs.

Though significant barriers remain to women of color receiving funding, there are female VCs who have stormed the proverbial gates of venture with the goal of leveling the playing field for entrepreneurs who don’t fall into the SV mold.

Below are 10 ambitious black female venture capitalists who are investing in entrepreneurs from all demographics but cast their net wider. These talented trailblazers have the ability to spot non-obvious deals that other VCs may miss at the early stage.

1. Melissa Bradley, Managing Partner – 1863 Ventures

Melissa Bradley is the Managing Partner of DC-based 1863 Ventures and co-founder of Ureeka, an online community marketplace for business owners. A dynamic speaker and advocate for people of color in tech, Melissa served as a Presidential Appointee under Presidents Clinton and Obama.

In 2015, Melissa launched Project 500 in Washington, D.C. with the goal of helping 500 underrepresented founders scale their companies. She exceeded that goal and upon seeing the dearth of funding for entrepreneurs of color, she set her sights on venture capital. She founded 1863 Ventures with just that goal. Today she runs her own fund and is an advisor to the New Voices Fund, which is run by Rich Dennis of Essence.

You can follow her here: @bradleyml

2. Sarah Kunst, Managing Director – Cleo Capital

Sarah Kunst, managing director of Cleo Capital, is an investor and entrepreneur who has worked at Apple, Red Bull, Chanel & Mohr Davidow Ventures. She was the founder of LA Dodgers backed Proday. She is also a contributing editor at Marie Claire Magazine. Her philanthropic interests include the boards of the Michigan State University Foundation Endowment.

Kunst has been named a Forbes Magazine 30 under 30 and a top 25 innovator in tech by Cool Hunting. She has been recognized for her work in Business Insider as a 30 under 30 Woman in Tech and Top African-American in Tech & Pitchbook Top Black VC To Watch and Marie Claire Magazine named her a Young Gun to watch. She has written for Techcrunch, Forbes, Wall St. Journal, Fortune and Entrepreneur.com. Marc Andreessen named her one of his 55 Unknown Rock Stars in Tech.

You can follow her here:@sarahkunst

3. Arlan Hamilton, Founder + Managing Partner – Backstage Capital

Arlan is perhaps one of the most outspoken voices in venture right now. She uses her social media platforms not only to promote her venture firm Backstage but also to talk candidly about challenges facing ‘underestimated’ startup founders.

Arlan built her venture capital fund from the ground up, while experiencing stints of homelessness. She is well-known for being the founder and managing partner of Backstage Capital, a fund that is dedicated to minimizing funding disparities in tech by investing in high-potential founders who are people of color, women, and/or LGBT. Backstage has now invested nearly $7m into 130 startups led by underestimated founders. Portfolio companies include Capway, Goalsetter, Blendoor, and My Money My Future, among others. In 2018 Arlan co-founded Backstage Studio, which launched Backstage Accelerator.

You can follow her here: @ArlanWasHere

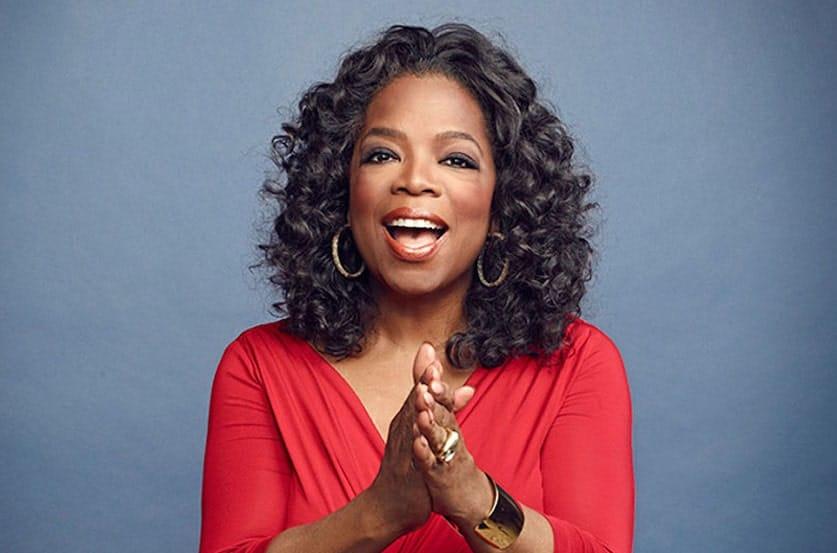

Black Female Venture Capitalists

4. Monique Idlett-Mosley, Founder and Managing Partner – Reign Venture Capital

Monique Idlett-Mosley made her transition from the music business managing top acts and founded Reign Ventures in 2017. Her $25m fund invests at the seed and Series A stages because she believes that women should support and invest in one another. Before founding Reign, however, Idlett-Mosley cut her teeth as a successful advertising executive and after that was an avid angel investor. During that time, she was shocked to find only a few minority founders. This led her on a mission to be intentional about investing in founders of color. To date, Reign Ventures has invested in startups such as Solo, LSNR, and Wizely Finance.

You can follow her here: @Monique_Mosley_

RELATED: THE RISE OF DIVERSITY FOCUSED VENTURE CAPITAL

5. Ulili Onovakpuri, Partner – Kapor Capital

Ulili is a rising star in the VC ecosystem and was recently promoted to partner from Principal at Kapor Capital. Her name originates from the Urhobo language of southern Nigeria and means ‘glory be to God.’ As someone who was diagnosed with rheumatoid arthritis as a child, she is using her first-hand experience of health issues to lead the healthcare and people operations tech portfolio at Kapor. A graduate of Duke’s Fuqua School of Business, majoring in Health Sector Management, Ulili has led investments in mSurvey and tECHquitable among others. Previously, she served as the Director of Global Programs and Village Capital, an accelerator program and venture firm supporting healthcare, education and agriculture businesses.

You can follow her here: @unolil

Ulili Onovakpuri, Partner – Kapor Capital

6. Monique Woodard – Cake Ventures

Silicon Valley OG and co-founder of Black Founders, Monique cut her teeth in venture as a partner at 500 Startups where she expanded their reach into the African continent. Before that, Monique was an inaugural fellow in the San Francisco Mayor’s office of civil innovation where she focused on internet and broadband access to some of the city’s poorest neighborhoods. Most recently, she has been raising her fund, Cake Ventures but along the way, she has been working on an initiative designed to address the challenges faced by entrepreneurs of color who lack access to capital and other resources when scaling their businesses. Monique is also an angel investor and has invested in notable startups founded by women of color such as Blavity, Encantos, and Mented Cosmetics.

You can follow her here: @MoniqueWoodard

7. Karen Kerr, Executive Managing Director – GE Ventures

Karen Kerr is a passionate supporter of entrepreneurs with over 20 years’ experience as an investor and advisor. Today, she serves as the Executive MD at GE Ventures, a firm that invests but is also is in the business of IP, new business creation, and development of cutting-edge technologies. Karen and her team invest in energy, mobility, and supply chain technology solutions that drive efficiency at GE.

Karen holds a Ph.D. in Physical Chemistry from the University of Chicago and an AB in Chemistry from Bryn Mawr College. She serves on a number of boards including Kauffmann Fellows and the Bryn Mawr College Board of Trustees. Most recently, Karen has been named as one of the leaders of the Rising America Fund, the first fund of its kind to be led by a team of African-American and Latinx women partners. The fund will invest in early-stage and growth companies in the US and is targeting a $5m raise.

You can follow her here: @karenekerr

8. Arian Simone, Founding Partner – Fearless Fund

Arian Simone went from living in her car to building and running a successful PR and marketing firm. She is a multi-hyphenate who speaks about her journey on stages all over the world and has been featured in major magazines globally. But her passion has always been to assist female entrepreneurs to achieve their dreams. To that end, Simone founded Fearless Fund with her partners Keisha Knight Pulliam and Ayana Parsons. The $5m fund is aiming to support women of color-led businesses seeking seed, pre-seed or series A financing.

You can follow her here: info@ariansimone.com

9. Kesha Cash, General Partner – Impact America Fund

Kesha Cash has been at the forefront of impact investing for quite some time now. As general partner of the Impact America Fund, she is dedicated to investing in entrepreneurs who she believes ultimately will improve the quality of life for underserved communities.

Kesha started her career as an analyst at Merrill Lynch and then later at Bridges Venture in London. She launched the Impact America Fund in 2013 with $10m. Since then, Cash was named one of Fast Company’s 100 Most Creative People in 2018 and dubbed a “Top Five Gamechanger” by Forbes Magazine. Notable investments include Connxus, Mayvenn, and CareAcademy.

You can follow her here: @KeshaCashIAFund

10. Ebony Pope, Principal – Rethink Education

Ebony Pope is a Principal at Rethink Education, a platform that oversees and facilitates the development of a suite of impact investment vehicles focusing on financial and social returns. Ebony is passionate about empowering underserved communities and made her way to venture after a short stint in philanthropy. Prior to working at Rethink, Ebony spent 3 years at Village Capital where she worked her way up from Senior Associate to Director of US Ventures. While there, she led the work of finding and supporting startups in 5 sectors. Ebony is a graduate of the University of Michigan’s Ross School of Business where she received her MBA.

You can follow her here: @PopeNotOlivia

Sian Morson is an investor, startup advisor and serial entrepreneur. Follow Sian on Twitter @sianmorson