Hate Working In Your Home Office? Change It Today!

September 6, 2016

From Home To Office: Everything You Need To Know About Moving

September 6, 2016Some people make the mistake of getting into debt without realizing what it can affect. Poor financial management can lead to a bad credit score. When your credit score is low, you may have problems getting loans or mortgages, buying a house or booking accommodation.

Due to the adverse impacts of a low rating, it’s crucial that you try to maintain a good credit score. There are many sites online which let you check your credit score. If you find that yours is already low, here’s what you should do.

Be Careful With Loans

If you have taken out loans and still have to pay them back, you should try to reduce the debt as soon as possible. Don’t get into the habit of covering debt with more loans. Instead, you should manage your money to start reducing debt altogether.

In cases where you absolutely need to borrow money, some loan companies offer bad credit lending. These types of loans are used in emergency situations. If people need to make a quick car repair or have medical bills, payday lenders will overlook bad credit scores. Paying these off late can still affect your credit score, so it’s best to borrow when you know you can pay them back quickly.

The less amount you owe on loans, the better your rating will be. You should make a plan for how you will pay off loans from paycheck to paycheck. There are also services which can consolidate loans into one monthly payment.

Plan Your Spending

Each week, you should check how much money you have coming in and budget wisely. Paying off bills and debts should be your top priority. Ensure that you also have enough for necessities like food and gas.

It’s better to plan your shopping into occasional shopping sprees. Some credit rating organizations only monitor spending activity for the past month. Having larger spends less frequently looks better than constantly spending throughout the month.

As well as improving your credit score, this can help you spend less. You can plan what you need to buy and reduce the likelihood of impulse buys.

Reduce Credit Card Usage

Having a lot of credit cards can make your credit score worse, especially if you’re using a lot of balance. Cancel any unused credit cards, as these can leave you more open to fraud as well as affecting your credit score. You should also aim to use less balance on your cards.

The best idea is to only keep one credit card. This will make things much easier to manage. You should also ensure you’re not digging too far into your credit card balance. The more credit you use, the more it impacts your rating negatively.

Pay Your Bills

Failure to pay bills on time can stay on your credit history for a long time. It’s best to pay them off as soon as possible, even if landlords or companies allow late payments. Later payments will cause you more problems in the future when it comes to finance.

Bills like rent and utilities are the first thing you should pay off. It will give you one less thing to worry about and one more thing to improve your credit rating.

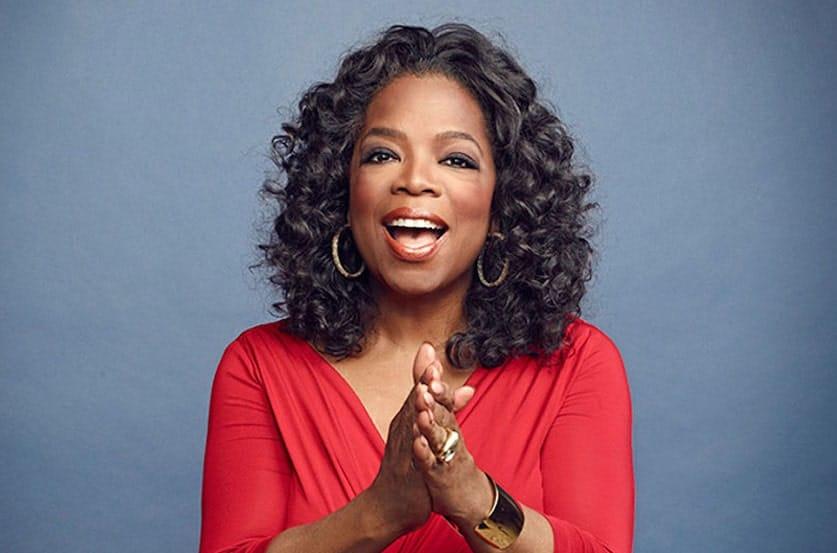

Main Image: Picture source