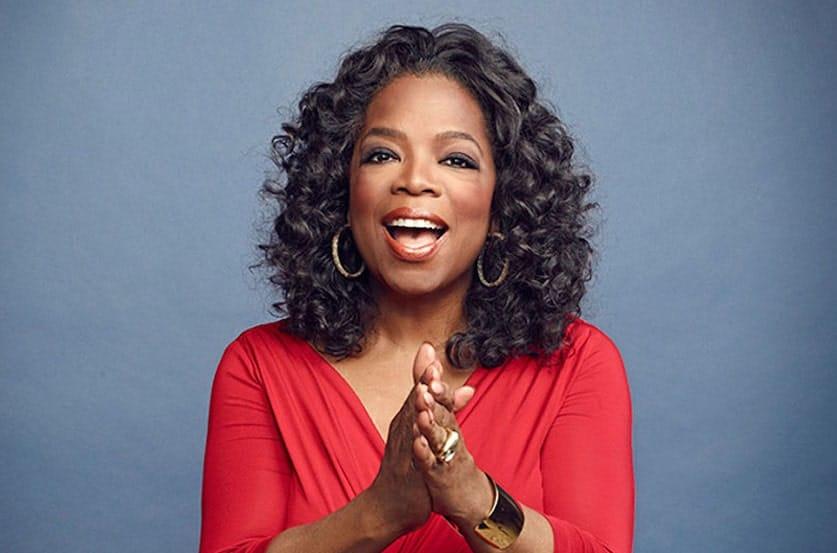

Meet The Woman On a Mission To Disrupt Philanthropy Through Tech

September 11, 2017

BronzeLens Festival honors “Icon Superstar” Queen Latifah at Women Superstars Luncheon

September 13, 2017Managing one’s personal finances is a vital skill for any self-employed individual. It is important from both a business and a personal perspective, as effective money management requires a sustained and consistent approach to money.

Many of those who become self-employed do so having had no prior experience of managing money, let alone within the context of a business environment. Because of this, it is crucial that newcomers to the world of being self-employed are adequately prepared to deal with this new level of responsibility, especially considering that the stakes are so high. A business can succeed or fail based on the quality of the financial management that underpins it.

Fortunately, good financial management isn’t some mystical, unobtainable skill. In fact, it is largely a case of common sense and willpower. So long as one is prepared to change their behavior and to forego unnecessarily and frivolous purchasing options then most money management occurs automatically. Below, are some top tips for those who are new to the world of being self-employed and are looking for some tips as to how best to manage their personal finances.

Be Honest About Your Expenses

This tip actually has two different meanings. First of all, you need to be clear and honest about business costs and remember that, ultimately, all self-employed people have costs of some kind. Even if those costs are as mundane as paying for the electricity to run the computer, that still represents an expenditure and it needs to be accounted for.

While it is likely that any self-employed business will easily generate enough money to cover the modest cost of running a computer, it is still worth understanding how much money this represents. After all, simply turning off electrical devices that aren’t in use is one of the easiest and most effective ways of saving money on bills. Once you have accounted for all the necessary outgoings to keep the business functioning, you will then have a much clearer picture of how much money you need to be bringing in in order to keep your balance sheet out of the red.

Being honest about your expenses also means being honest about what constitutes a necessary expenditure. You will obviously want to minimise the amount of money that you are spending needlessly as part of any broader effort to better manage your finances. As a self-employed individual, it can be tempting to write off as expenses some things that you really shouldn’t. Always consider whether you really need to be spending money and whether you will be able to justify any spending in terms of return to the business.

Manage Your Income

Being self-employed usually means that you can never be certain of money coming in on a regular basis. For this reason, it is necessary to set aside money whenever possible to act as a cushion during harder times. A certain chunk of your profits should go into ensuring that you can afford to run your business should income temporarily dry up.

One option for self-employed individuals who find themselves temporarily without cash is to take out a small, short-term loan. By making use of a loan calculator, you can establish what sort of loan might be suitable for your circumstances based on the amount of money you are earning versus your monthly expenditure.

Be Wary of Debt

Any debt you accumulate will eat into your monthly profits and repayments on various loans can pile up fast. Whenever you find yourself with money to spend, repaying any debts and other obligations your business currently has should be a priority.

This is another reason why a loan calculator is a good idea, as it can help you avoid committing to a debt you won’t be able to repay. A common mistake made by new entrepreneurs is to accumulate a large amount of debt on credit cards under the assumption that they will soon make enough money to pay it back. It is important that you are always realistic in your expectations, especially when it comes to devising financial forecasts and spending plans. There will always be circumstances beyond your control at play, particularly for a self-employed individual.

Keep Accurate Records

This is absolutely key to ensuring that managing your own finances is easy. Good, thorough, and accurate record keeping means that you should be able to gain a good overview of your finances with little more than a glance at your records. If your record keeping is good then you will find that information sinks in as you record it and you will build a much clearer internal image of your company’s financial position.

If you plan on taking out a loan, or otherwise taking on more debt, then accurate records will make it much easier to establish how safe your finances are. Combining this with a loan calculator makes for an almost fool-proof checking system.

Managing money is important for self-employed individuals. Fortunately, it is simple enough to do and making improvements in the managing of one’s personal finances will have numerous positive effects on the finances of one’s business.