Retail Veteran Latriece Watkins Takes the Helm at Sam’s Club

January 16, 2026

Zoe Saldaña is Now Highest-Grossing Actor of All Time

January 20, 2026Nigerian mobility financing startup, MAX, has raised $24 million in a combined equity and debt funding round to accelerate its transition to electric vehicle (EV) financing across Africa.

The equity round saw participation from Equitane DMCC, Novastar, Endeavor Catalyst, and other global investors, alongside asset-backed debt from the Energy Entrepreneurs Growth Fund (EEGF) and development finance partners. Novastar, an existing investor, also participated, following its involvement in MAX’s Series B round in September 2025.

The funding will help expand Metro Africa Xpress’s (MAX) electric vehicle fleet, battery-swapping and clean energy infrastructure, proprietary fleet management systems, and its footprint across West and Central Africa.

Related Post: Gen Z-led Terra Industries Raises $11.75M to Scale African Defense

Achieving Profitable Status and Securing New Capital

The raise indicates strong investor confidence in MAX’s transition from traditional vehicle financing to an integrated electric mobility platform. The company’s growth mirrors a broader uptick in Africa’s EV ecosystem, where declining battery costs and volatile fuel prices make electric two- and three-wheelers increasingly competitive.

“This capital allows us to scale faster, deepen clean energy infrastructure, and build a truly pan-African mobility platform that expands access, lowers costs, and delivers durable impact,” said Adetayo Bamiduro, MAX’s Chief Executive Officer.

The company achieved profitable status and secured new capital in February 2025 after pivoting to EV financing. This strategic shift included reducing its workforce by about 150 employees (30% of staff) as part of an operational restructuring.

During this period, MAX implemented cost-reduction initiatives to boost efficiency and improve capital management. These initiatives included reducing energy consumption and discontinuing less profitable business lines.

MAX’s profitability stems from its integrated pay-as-you-go (PAYG) model, prioritizing cash flow management over aggressive growth. To date, MAX has deployed over $56 million in fleet financing and recovered $44 million in repayments from users. “Profitability in Nigeria proves that electric mobility in Africa is not a future concept. It is viable, scalable, and investable today,” Bamiduro emphasized.

Related Post: Flutterwave Acquires Nigerian Mono in Strategic Push for Open Banking

The Next Steps for MAX

The Nigerian startup’s approach focuses on reducing reliance on costly imports by promoting local manufacturing. The startup, which began deploying EVs in 2020, partners with local and regional original equipment manufacturers (OEMs) like Yamaha, Hero, and Spiro to supply vehicles suited for African roads.

MAX’s growth aligns with Africa’s accelerating adoption of electric mobility. Falling battery prices and volatile fuel costs make EVs increasingly competitive versus gasoline-powered options for commercial operators. With around 20,000 EVs on Nigerian roads and a projected annual growth rate of 30.6%, the EV industry is becoming a viable, industrial-scale market.

Proceeds will expand MAX’s EV fleet, battery-swapping infrastructure, fleet management systems, and presence in West and Central Africa. The company aims to support 250,000 drivers by 2027 and exceed $150 million in annual revenue.

Related Post: African Unicorn Moniepoint Raises Additional $90M for Expansion Plans

Founded in 2015 by Adetayo Bamiduro and Chinedu Azodoh, MAX has evolved from delivery to ride-hailing, vehicle financing, and EV assembly. To date, MAX has raised about $87 million, including a $31 million Series B round (2021) and over $40 million in institutional debt (2021-2022).

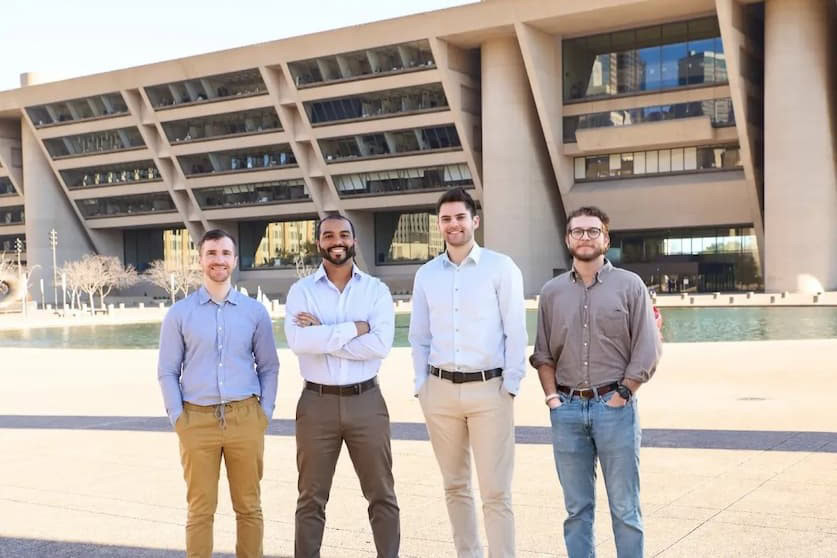

Main Image: MAX Co-founders, Adetayo Bamiduro, Chinedu Azodoh, and former CFO, Guy-Bertrand Njoya. Image Credit: MAX