How to Create a Successful Mobile App

September 28, 2017

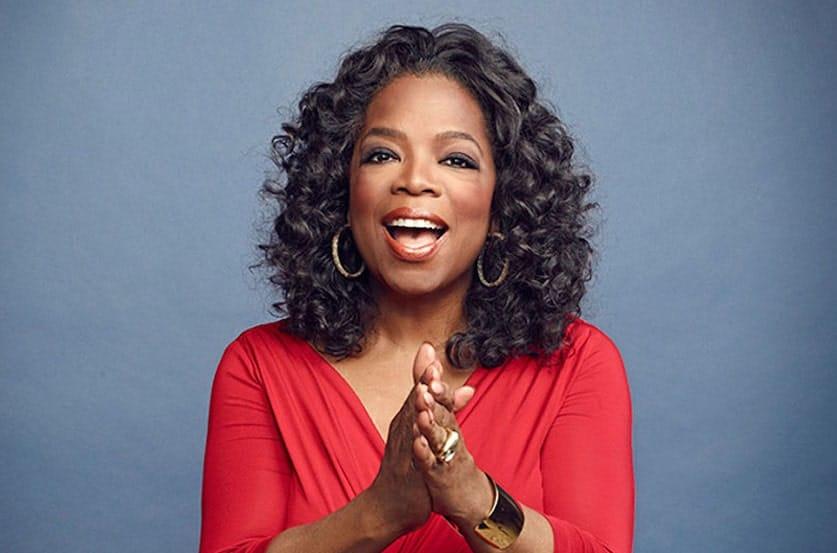

Leslie Hocker – Startup Successes To Whet Your Appetite

September 28, 2017Sponsored Content: If you are ready to venture into the business world, you will discover that there are many options. You can decide to start your own small business or purchase one from another owner. However, another good alternative could be acquiring a franchise. While it may be more profitable in the future, it can be quite pricey to get one since you will need to pay a certain sum to the license holder and there are also the usual costs. However, if you are determined to finance a franchise, here is everything you should know about one.

Defining a franchise

First things first, let’s see what a franchise is and what are its main benefits. A franchise allows you to purchase to rights to sell and distribute the products of a certain company, using their resources and their brand. There are individual restaurants which are just a franchise, and there is the parent company that allows them to use their image in exchange for a fee. A franchise has to adhere to certain business standards in order to respect the rights of its main company.

The main advantage of franchises is that there already is a loyal customer base, and people will already be familiar with your products and image. But this is also the reason why purchasing a franchise is more expensive than just opening your own business. Nevertheless, many people agree that it is worth it.

Find funds for your franchise

Now that you know what is the franchise that you want to acquire and you are aware of the costs, you should find a way to finance it. There are not many people that are lucky enough to have all the necessary funds, but there are other ways to obtain the money.

For example, you can try applying for a business loan. You can try the traditional way, and go to a bank, or you can give sba loans a try. Bank loans work nicely with franchise purchasing, especially if the brand is a successful one. Another good thing is that business loans have lower interest rates. However, you should also consider small business administration loans since they are backed by the federal government and it comes with plenty of benefits. It is easier to get these loans and they usually run between three and five years.

There are some franchise owners that will help you with your franchise using internal finance. Basically, you will be able to finance your franchise internally thanks to the parent company.

If you are part of a less privileged minority you can take advantage of certain government initiatives. There are some loans that are available for minority or women business owners. The aim of these organizations is to help owners that are not usually represented in the business community.

You are also in luck if you are a military member. The Department of Veterans Affairs has a great program that will help you with the funds you need. You can loan $500.000 with the Patriot Express program, and the rates are extremely low.