MEFeater Magazine Chief Exec Lands Spot on Forbes 30 Under 30 List

December 5, 2022

Meet the Trailblazer Closing the Racial Wealth Gap by Supporting Black-Led Businesses

December 14, 2022Meet 10 Black Male VCs Leading Venture Capital Firms Managing $100M+

Less than 1% of venture capital-backed founders are African American, and the stats are similarly dire when we look at those calling the shots within the VC industry. A new study by NVCA reports that Black employees comprise 3% of the venture workforce compared to the vast majority who are white men.

Still, there are a growing number of change-makers in venture who understand the importance and untapped potential of minority founders. These Black investors intentionally support and invest in diverse portfolios, in some cases focusing almost entirely on women and minority founders.

Below is a list of 10 leading Black Venture Capitalists making waves in the VC industry; all managing funds that have raised over $100M. Combined, these funds are responsible for getting around $3 Billion of VC funding into the hands of qualified entrepreneurs.

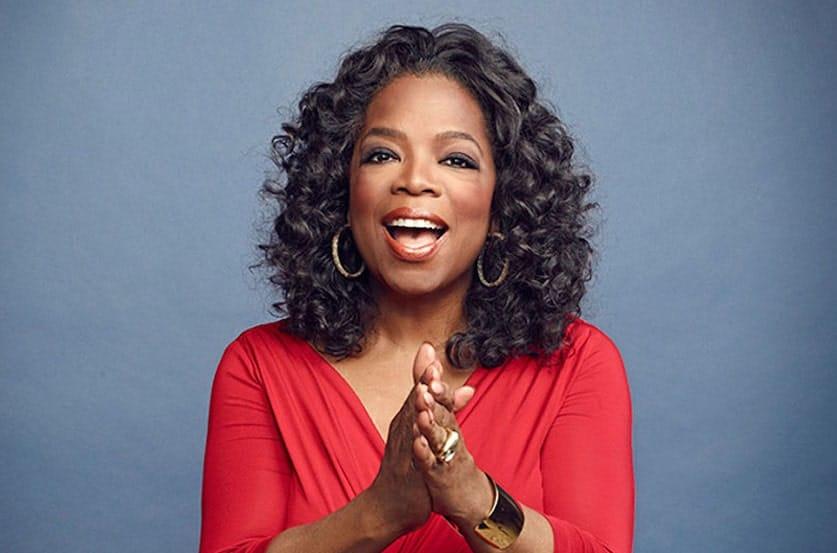

1. Adeyemi Ajao, Managing Partner – Base10

Born to a Spanish mother and Nigerian father, Adeyemi Ajao, spent his formative years in Nigeria and Italy before his family moved to Spain when he was nine years old. Ajao studied in Spain before embarking on an MBA at Stanford. He also holds a J.D. in Law and an M.S. in Economics from Icade University in Spain and studied for a certificate in Machine Learning at Stanford.

With a track record as a successful serial VC-backed entrepreneur, Ade co-founded Base10 in 2018 with TJ Nahigan. The fund is the first Black-led VC firm to manage over $ 1 billion in assets. “We like to invest outside of Silicon Valley,” says Ajao, “Base10 invests globally with portfolio companies in the US, Europe, Latin America and Africa.” Roughly 60% of the firm’s investments are in companies led by women or minority founders. The firm has committed to a diversity pledge, investing 1% of its profits to support organizations fighting for inclusion and racial equality.

2. Marlon Nichols, General Managing Partner – MaC Venture Capital

Marlon Nichols is a seasoned venture capitalist. Founder of Cross Culture Ventures and previously Investment Director at Intel Capital he has turned his expert hand to MaC Venture Capital. Having raised $110m in its inaugural seed-stage fund, MaC intends to invest in 40 seed-stage companies across the world. “We look for ambitious founders who want to build billion-dollar category leaders,” said Adrian Fenty, who is also a managing general partner at MaC.

MaC Venture Capital recognizes not only its capacity to invest in Black and Brown founders but the importance of powering “companies that are closing the opportunity gap for large groups of people and create more diversity across a wide range of verticals,” said Nichols, managing general partner. MaC offers a hands-on approach, providing operations strategy, brand building, and recruiting support to entrepreneurs within its portfolio. The firm’s limited partners include Foot Locker Inc, Goldman Sachs, Bank of America, and the University of Michigan.

Black Male Venture Capitalists

3. Ollen Douglass, Managing Partner – Motley Fool Ventures

University of Baltimore alum Ollen Douglass is a Managing Partner at Motley Fool Ventures. Prior to joining the Fund, Ollen was CFO of The Motley Fool Holdings, Inc. for 14 years. During that time, He was responsible for the overall financial health of the Fool and helped guide the company through periods of major growth, contraction, and market volatility.

Launched in 2018, Motley Fool Ventures invests in early-stage companies that are leveraging technology to create a clear competitive advantage in their industry. The fund invests between $500,000 and $2M, leaving room for follow-on investment. The MFV portfolio includes Finli, a mobile-first payment management company, which has just achieved $6m in a seed funding round led by MFV. Other investments include Esusu, a fintech specializing in rent reporting and data solutions for credit building which raised $10m in a Series A round led by MFV and Serena Ventures. In total, MFV is managing $252M. The goal is to raise at least another $200M.

4. Brian Dixon, Managing Partner – Kapor Capital

Brian Dixon started out as an intern at Kapor Capital and is a now Managing Partner at the Oakland-based venture capital firm. This makes him one of the youngest African-American Partners at a Silicon Valley fund. He is committed to making sure entrepreneurs of all backgrounds have access to advice and capital in order to make their businesses succeed

One of the largest Black-led VC firms by assets, Kapor Capital prioritizes a more fair, just, and equitable society for low-income communities and underrepresented communities of color. The firm raised $126m in September to invest in pre-seed, seed-stage, and Series A startups. Managing partner Ulili Onovakpuri describes the difficult process of raising funds, citing racism among investors. The firm is seeking to change this, with a particular focus on startups that address problems within African-American and Latinx communities. Kapor Capital seeks to see early-stage companies embed inclusion and diversity at the core of the company’s DNA. In 2015, Kapor Capital’s founders set up their G.I.V.E commitment in 2016, whose pillars are establishing diversity and inclusion goals, investing in people ops technology to counteract bias, organizing volunteering opportunities, and providing education.

5. Aaron Holiday, Managing Partner – 645 Ventures

Cornell University MBA alum Aaron Holiday is the co-founder and Managing Partner of 645 Ventures. Holiday, a Morehouse Computer Science grad, co-founded 645 Ventures 9 years ago with Nnamdi Okike.

645 Ventures is an early-stage venture capital firm that invests in building iconic companies. 645 Ventures applies a data-intensive approach to investing in top software and Internet companies. Providing up to $5m investment at Seed and $15m at Series A stage, 645 Ventures has just overseen its fourth fund and first opportunity fund. Closing these rounds, the firm raised a total of $347M, a marker of its exponential growth, which has seen its portfolio soar to over fifty companies. The firm plans to make about 30 new investments, maintaining its focus on growth funding, and backing the best companies the firm saw through its early-stage fund.

6. Kanyi Maqubela – Managing Partner – Kindred Ventures

Stanford grad Kanyi Maqubela counts fluency in Spanish, Xhosa, and Zulu and a stint as Adjunct Professor at NYU amongst his many talents. Maqubela co-founded Kindred Ventures in 2014 with Steve Jang with the mission of backing visionary founders, either through investment in technology startups or through the assembly of talented founders to form startups.

The fund is notable for its refusal to zero in on any one sector of tech entrepreneurship. Jang was a founding advisor and early-stage investor in Uber and Maqubela served as a partner at Collaborative Fund where he was an early advisor to Tala and Walker & Co. before they partnered to design their seed VC platform, Kindred. In 2021 Kindred closed its second fund with $100m, on top of its $56m debut fund two years prior.

7. Paul Judge, Managing Partner – Panoramic Ventures

Serial founder Dr. Paul Judge has over 60 investments to his name, making him one of Atlanta’s most successful serial tech entrepreneurs. Cofounder of TechSquare Labs, Purewire, Judge was brought on board at Panoramic Ventures as a co-founder in 2021. He now sits as Managing Partner.

Boasting one of the most impressive portfolios in the Southeast, an area that only receives 14% of funding despite representing 44% of the country’s population, Panoramic Ventures touts’ successful investments in Car360, Pindrop, and Tricentis among others. Panoramic Ventures takes a holistic approach to funding, opening doors to overlooked founders. With over $550m in assets under management in 2021, the firm has since launched a new fund with a target of $300m. “As a minority who has built companies outside of the traditional tech hubs, I know what it is like to be an overlooked founder,” says Judge. “From Atlanta to Miami, from the Southeast to the Midwest, Panoramic wants to back promising founders and extend capital opportunities that may not have previously existed.”

8. Henri Pierre-Jacques, Managing Partner – Harlem Capital

Harlem Capital’s co-founder and Managing Partner Henri Pierre-Jacques holds an MBA from Harvard Business School. He is a Forbes 30 under 30 accolade, and currently sits on the board of Amazon Black Business Accelerator Board. With 24 investment leads to his name and experience on 7 boards, he co-founded Harlem Capital with the ambitious aim of changing the face of entrepreneurship by investing in 1000 diverse founders over 20 years.

Recognizing that communities of color and exporters of cultural and economic value, Harlem Capital has invested in 91% diverse founders and 43% female founders across 49 investments spanning 13 cities and 3 countries. Founders Henri Pierre-Jacques and Jarrid Tingle have gone from their first venture capital fund of $40m in 2018 to a second fund in 2021 of $134m, with anchor checks from Apple, PayPal, and return investor TPG Capital. “There were no other funds that were racially focused with diverse people at the top,” says Pierre-Jacques. “So we felt like we had to start it ourselves.” Harlem is now able to use its funding to invest in fintech, e-commerce, HR tech, property, and wellness.

9. Managing Partner Charles Hudson, Managing Partner – Precursor Ventures

Managing Partner Charles Hudson has nearly two decades of business management experience in the tech and virtual sphere. An alum of Stanford Graduate Business School where he has returned to lecture, he is the founder of the Virtual Goods and Social Gaming Summits respectively.

In 2015 he founded Precursor Ventures on the simple premise: that all entrepreneurs, regardless of background, benefit from having an institutional investor to help them scale and grow their company from the very beginning. Since its foundation, Precursor Ventures has made nearly 400 investments in companies headquartered in North America (including the US, Canada, and Mexico). Hudson previously worked at Google, IronPort Systems which was acquired by Cisco Systems in 2017 for $830m, and IN-Q-Tel, the strategic venture capital group for the CIA, before launching his own firm.

10 Don Thompson, CEO and Founder – Cleveland Avenue

Former McDonald’s Corporation CEO and President Don Thompson founded venture capital fund Cleveland Avenue in 2015. An electrical engineer by trade, Thompson has one of the most impressive career trajectories in corporate America. He brings his vast expertise and passion for innovation and digital trends to his VC firm.

Headquartered in Chicago, Cleveland Avenue is focused on building food, beverage, and restaurant concepts. The firm drives growth at all stages, investing in talented ventures like BeyondMeat, Ayo Foods, and Farmer’s Fridge. In early December 2022 Cleveland Avenue led a Series A funding round for Verdant Robotics, which closed at $46.5m. Liz Thompson, Don’s partner of 30 years, is at the helm of the Cleveland Avenue Foundation for education, focused on college access and career attainment.

If there are any other outstanding Black Male VCs we should know about please add their details in our comments section.

Main Image: Base10 Managing Partner Adeyemi Ajao (right) with co-founder TJ Nahigan